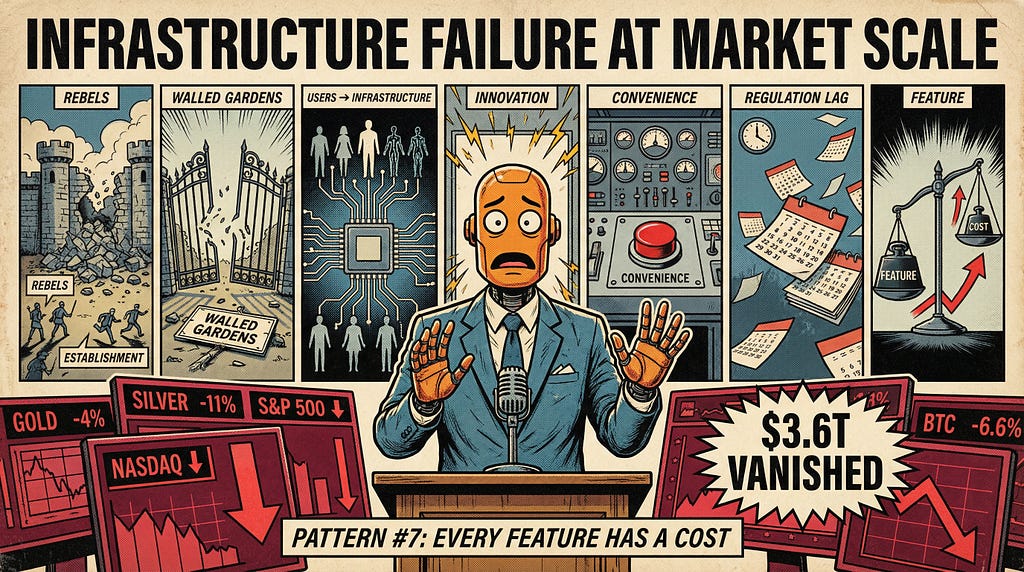

The recent market upheaval from February 11-12 was not just a crash but rather a significant distributed systems failure on a global scale. This incident underscores the critical insight that, as technology evolves, every optimization carries inherent costs.

“This wasn’t a market crash. This was Pattern #7: Every Feature Has a Cost.”

On February 11, a surprising jobs report shattered existing market assumptions, triggering cascading failures that decimated over $3.6 trillion in global value by the next day. Algorithmic trading systems, optimized for speed, reacted instantly to stress signals, leading to simultaneous sell-offs across various assets.

Key Insights:

- Speed vs. Stability: While AI systems may enhance efficiency, they can also make market infrastructure more fragile.

- Concentration Risk: The market is increasingly dependent on a few dominant AI technologies, amplifying vulnerability.

- Understanding Dependencies: Developers and investors must scrutinize the dependencies within their systems to mitigate risks.

This incident serves as a clarion call for developers and investors alike: Are you aware of the fragility hidden within your systems and investments? To delve deeper into these revealing patterns, explore the full article and its insights on navigating future challenges.

Read the full story for more details:

Continue reading